E2 Visa Business Plan Defined

An E2 Treaty Investor Visa is a nonimmigrant visa which allows a foreign investor who is a national of an E2 treaty country to make a substantial investment in a new or existing U.S. enterprise and go to the U.S. to direct and develop this business.

An E2 Business Plan is a document that supports your E-2 Treaty Visa application process. It is one of the has many requirements related to the E2 Treaty Investor and the E2 enterprise, and it is also used to show proof of compliance with visa eligibility.

After submission of your application and business plan to the U.S. Embassy or Consulate, you will be invited to attend an interview. During the interview, you will then be asked about any information you have provided about yourself and the business you plan to establish.

The consular officer will scrutinize your business plan to the extent of how it will derive economic benefit to the U.S., so you have to be prepared to explain your plans and projections to prove that your E-2 enterprise will be more than marginal.

Importance of an E2 Business Plan

One of the crucial parts of your E-2 Visa process is making your business plan. If it’s poorly written, it could further delay your visa application process as the adjudicator would request more information. Worse, a poorly written business plan will result in a denied application.

Heed caution, however, as using a template might be risky. It’s important to note that the E2 business plan must explain your plans to contribute to the U.S. market and economy through your business.

The purpose of business plans is not really to attract business partners or investors but to convince adjudicators who will review your visa application to approve your visa and your business venture.

An E2 Visa business plan has virtually the may have the same content as that of a standard business plan, but it also has be to tailored to meet the specific E-2 visa requirements. You would need to include your investment funds, the source of your capital, and your operating strategies to establish and direct the enterprise. Further, it would include background information about you, an executive summary, and other business details.

Contents of an E2 Business Plan

It’s common for investors to be unsure of where to begin writing their business plan. There’s no hard and fast rule in creating business plans, and even if you already know what to write, you may still hit some blunders along the way.

There’s a high chance you might use a template if you’re unsure of what to write. However, especially for an E2 business plan, a template will likely leave out vital and necessary information that you would need for your visa application process.

The adjudicator will use the information and business plan you have submitted to decide whether you are qualified for the E2 Visa, so leaving out necessary information or failing to detail important information will likely result in a denial.

Your immigration business plan should include your business objectives, goals and forecast. It should show in detail how you will utilize your investment and how it’s sufficient to make the business operational to meet your goals. The business plan should also provide financial projections on how the business will achieve profitability and economic benefits that will contribute to the U.S.

The contents of your business plan will depend on the nature of your business, the investment amount, and the marketing strategies you’ll adopt to make the business thrive. We always recommend working with professional business plan writers who specialize in immigration-related business plans.

In general, your business plan should cover information regarding:

The company

You should include information regarding the company which is the focus of your investment. It should show whether it’s a new or existing business, its niche, its services or products, its projected economic benefits, and its business or operational strategies. You should prove that the company or enterprise is bona fide and that it will be able to employ qualified U.S. workers.

The investment

Aside from information about the company, you should also be able to detail more about your investment, whether it’s substantial and its lawful source. Your investment must also meet the requirements of the proportionality test

The applicant

Finally, you should also be able to include information about yourself as the investor, whether you can direct and develop the business. Detail as much as you can about your abilities and capabilities to develop and direct the business as well as your credibility so you can sufficiently convince the adjudicator.

Moreover, you have to include your intention to leave the U.S. upon the expiration of your visa as well as your intent to reside in the U.S. for the duration of your visa.

Elements of an E-2 Business Plan

In making your E2 Visa business plan, it should at least include the following:

- A business summary and description introducing the company briefly, its products and/or its services;

- A general overview of why you and your business are qualified for an E2 Visa;

- A detailed description of your intended purpose of developing and directing the business, which includes details that prove you’re entering the U.S. to run the business, that you own 50% of the business, and that you will be responsible for its day-to-day operations;

- A target market analysis and industry analysis which includes information about business conditions, business competitors, budget and personnel requirements, a description of your diverse client base, and a brief explanation of why the business will succeed in its market;

- A comprehensive marketing strategy for how the business will gain recognition from its target market, and will engage with the market;

- A detailed hiring plan which includes a description of each position you intend to hire, how many employees you plan to hire, and information on how your business will create new jobs for qualified U.S. workers for the next 5 years of its operations;

- A financial strategy includes financial projections, a balance sheet, a cash flow statement, a profit and loss statement, and an explanation for the figures and assumptions in these statements.

- Information that proves you’re in control of your investment funds, including evidence of the lawful source and substantiality of these funds with a clear paper trail;

- An operational strategy detailing your venture’s organization and management, a description of your skills and experience, and how these ensure your venture’s success and viability.

E-2 Visa Business Plan Reviewers

The consular officers from your home country’s U.S. Embassy or Consulate, and the United States Citizenship and Immigration Services are the ones who will read the comprehensive immigration business plans. There will be limited communication between you and the officer, so you have to include all necessary information in your business plan.

Issues in Writing an E2 Visa Business Plan

There might be several issues or problems you might come across while writing your business plan. You might ask, along the way, how you can prove that your investment is substantial. While there’s a definitive number on what’s considered a minimum investment, the investment is considered substantial depending on the nature of the business. The investment must be substantial in relation to the costs of setting up your enterprise.

Moreover, on the question if you’d need to indicate a commercial space, take note that a physical space or a commercial lease is not required in an E2 business plan. However, it’s still recommended that you obtain a lease for an office space because most officers still expect to see whether the E2 enterprise has an office and it also contributes in proving that the E2 enterprise is real and operating.

On the question of whether you need to spend money before your visa application is approved, it is an E2 Visa requirement that your investment funds are “at risk” so it’s given that you need to spend the capital before completing your application. However, it is possible to irrevocably commit the funds to your start up E2 enterprise without actually spending them at the time of the filing of the application. Our team can definitely guide you and help you in meeting this requirement and minimizing the risk of losing your investment.

Conclusion

A comprehensive business plan is an essential E-2 Visa requirement. To show that you are eligible for the visa classification you have to submit a business plan; E2 Visa, after all, is about investing substantial capital in a U.S. business.

You should take your time writing your business plan. Avoid using templates or sample business plans where you’ll just input information. If you’re unsure on what to write and where to start, you can ask help from immigration professionals, especially from those who have experience on handling E2 Visa applications.

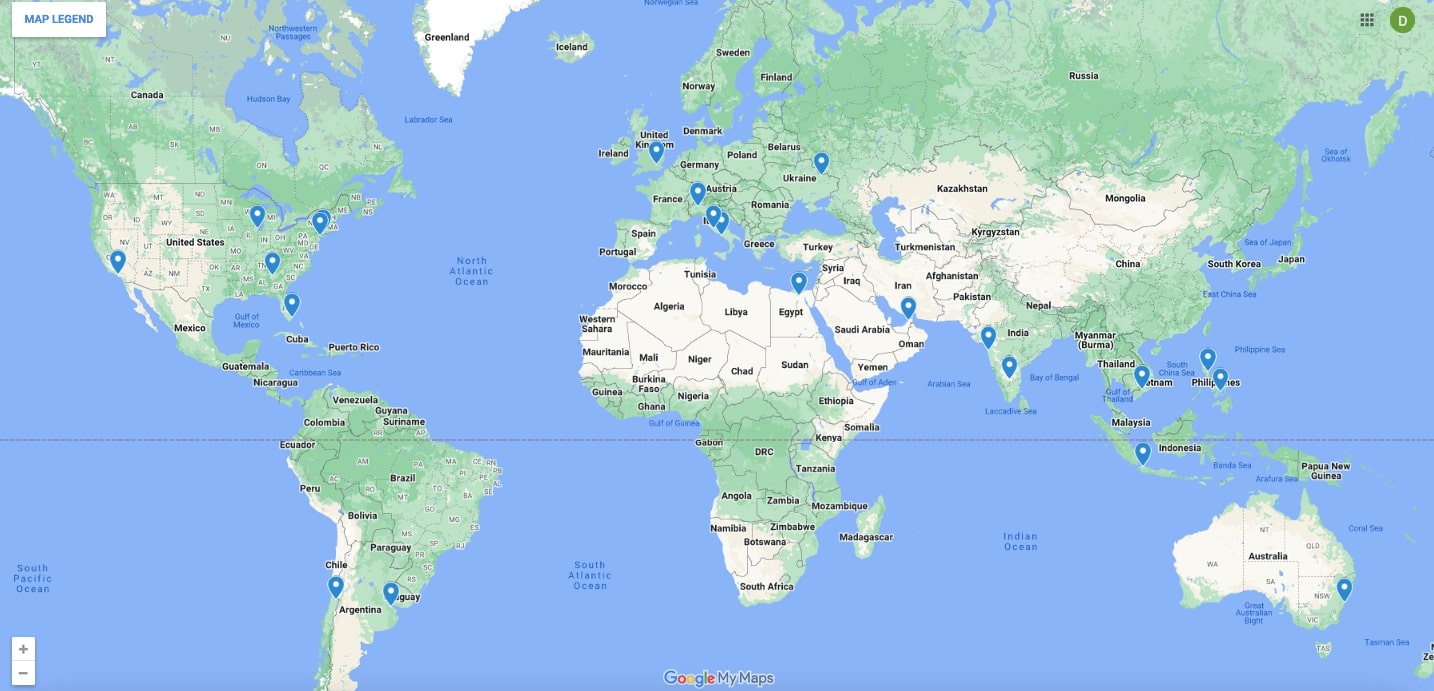

The immigration attorneys at Davies & Associates can help you prepare for your visa application process, and increase the chances of you getting approved with an E2 Visa with their skills and experience.

FAQs

Is there a minimum investment needed for an E2 Visa?

The investment capital is one of the most important components of your visa application and your E-2 Work Visa cost. While there is no definitive minimum amount of investment for an E2 Visa, the requirements are clear that the investment must be substantial. Substantial is measured depending on the nature of the business, its industry, and other relevant factors. It must be substantial enough related to the costs associated with the business.

How does a business plan comply with E2 Visa requirements?

Your business plan should show how your capital investment is going to be utilized together with financial, personnel, operational and marketing strategies.

Is the E2 Visa business plan the same as a standard business plan?

While a standard business plan and an E2 business plan are virtually the same, your E2 business plan must include comprehensive and extensive information about you, the background of your investment, and how beneficial your new venture would be for the U.S.