A lawsuit filed by an EB-5 Regional Center is taking aim at the November 2019 price hike for the EB-5 Investor Visa. If successful, the minimum investment amount for EB-5 would return to USD 500,000 in a Targeted Employment Area. A federal judge in California has indicated she may be willing to reverse the Trump-Era changes to the EB-5 program rules after a lawsuit filed by Behring Regional Center.

If successful, any changes would likely be short-lived. The EB-5 Regional Center Program is set to expire at the end of June and a reform and reauthorization proposal has started working its way through Congress could set the USD 900,000 minimum investment level in stone. It is our opinion that the new EB-5 law in June would be revised to increase the price back to itS current level.

This means that there may be an extremely short window of time, possibly as little as days, in which to file an EB-5 I-526 Petition at USD 500,000. Properly preparing a case to be filed can take weeks or longer depending on where the funds are coming from and will require investors to fund an EB-5 project which is configured to accept investment at that investment level. Any investor potentially interested in availing themselves of the USD 500,000 investment level should therefore have their case ready so it can be filed at a moment’s notice.

The minimum investment requirement for the EB-5 Investor Visa to USD 900,000 in November 2019 to take account of inflation since the program’s inception in the 1990s. The $900,000 amount relates to investments in a Targeted Employment Area (TEA) – areas with relatively high unemployment. Outside of TEAs the minimum investment requirement rose from USD 1 million to UDS 1.8 million. The November-2019 rule change also centralised decision making around what constitutes a TEA, transferring authority for this to the Department for Homeland Security.

The rule changes had a significant impact on EB-5 uptake with a sharp drop-off after November 2019. This was partly due to so many people rushing to apply, exhausting pent up demand. Covid slowed the recovery, but green shoots have been emerging as the pandemic recedes. Long term reform and reauthorization in June will provide much-needed certainty and confidence to future investors.

This federal court case could change calculations for some investors. If the price temporarily drops to USD 500,000 it could cause a massive rush to file EB-5 applications. The application process requires careful documentation of the source of funds used for the EB-5 investment. This can take time to prepare, so anyone considering an application or monitoring this court case for a drop in the investment level should contact us immediately.

The court case comes at a time of brief uncertainty for the EB-5 Investor Visa Program. With reauthorization of the Regional Center Program required before the it expires in June, would-be investors need to weigh their options carefully.

On the one hand, you could tie up your capital under uncertain conditions to pursue the EB-5 Regional Center in case it ends forever in June. Or on the other hand, you could wait until there is certainty in the second half of 2021, but know that the price of that certainty could mean the EB-5 route is closed to you forever. The risk is up to the client, but it is worth talking through your options with an immigration attorney.

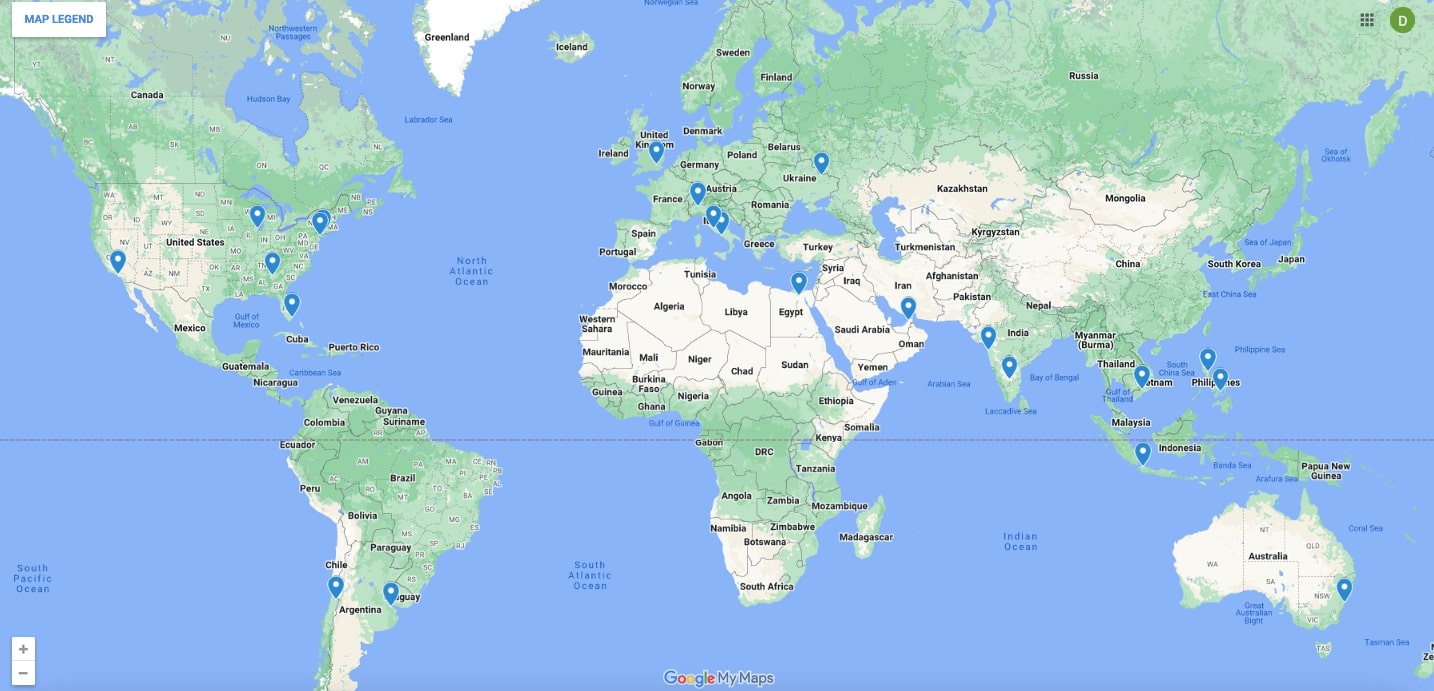

The likelihood is that the program will be renewed. The EB-5 Investor Visa brings in millions of dollars in investment and creates hundreds of thousands of jobs all across America at no cost to the taxpayer. It played a valuable role in America’s recovery from the 2008 financial crisis and could do something similar as the US economy recovers from Covid.

Anyone who has already applied for an EB-5 Visa but is waiting an adjudication may wish to file a writ of mandamus in federal court ahead of the June 2021 expiry date. Usually applicants should wait at least two years before resorting to legal action against the United States Citizenship & Immigration Services (USCIS), but the June expiration may change this. Contact us to discuss your specific circumstances.