The two EB-5 pathways explained

Under U.S. immigration law, EB-5 investors may qualify in one of two ways. Both pathways are authorized under INA §203(b)(5) and governed by implementing regulations and agency guidance.

Regional Center EB-5

Investment is made into a USCIS-designated regional center project, typically real estate or infrastructure, where job creation may be demonstrated through direct, indirect, and induced jobs using economic modeling.

Legal and policy framework

For a full overview of the EB-5 program, including timelines, costs, reserved visa categories, and process flow, see our EB-5 Visa Guide.

EB-5 Visa Guide

Direct EB-5 Myth: Investment Amount

A common myth is that Direct (Stand-Alone) EB-5 requires an investment of USD 1,050,000 whereas a Regional Center investment requires an investment of USD 800,000. This is false.

The investment required is related purely to the location of a project.

Direct (Stand-Alone) EB-5

Investment is made directly into a business that must itself create at least ten qualifying full-time U.S. jobs. All jobs must be direct, permanent, and W-2 employees of the enterprise, and must be proven through actual payroll and business records.

Legal and policy framework

For a detailed breakdown of Direct EB-5 structures, job creation rules, and compliance risks, see EB5 Direct.

Side-by-side comparison

| Factor |

Regional Center EB-5 |

Direct (Stand-Alone) EB-5 |

| Governing statute |

INA §203(b)(5)(E) |

INA §203(b)(5)(A) |

| Regulations |

8 CFR §204.6 |

8 CFR §204.6(j) |

| Job creation |

Direct, indirect, and induced |

Direct W-2 jobs only |

| Jobs required |

10 per investor |

10 per investor |

| Job proof |

Economic modeling |

No modelling, payroll and tax records |

| Investor role |

Passive or policy-level |

Active or policy-level |

| Petition form |

Form I-526E |

Form I-526 |

| USCIS scrutiny |

Moderate |

High |

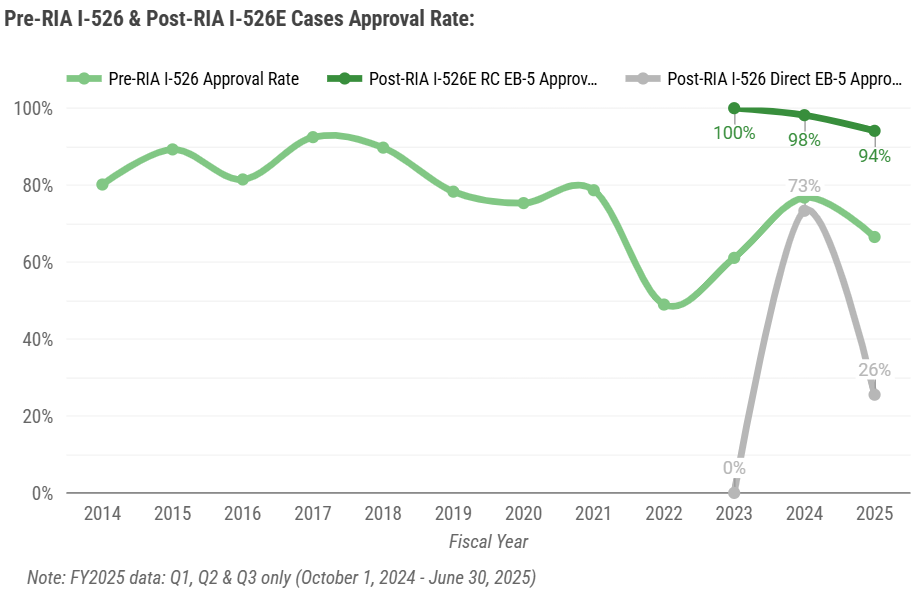

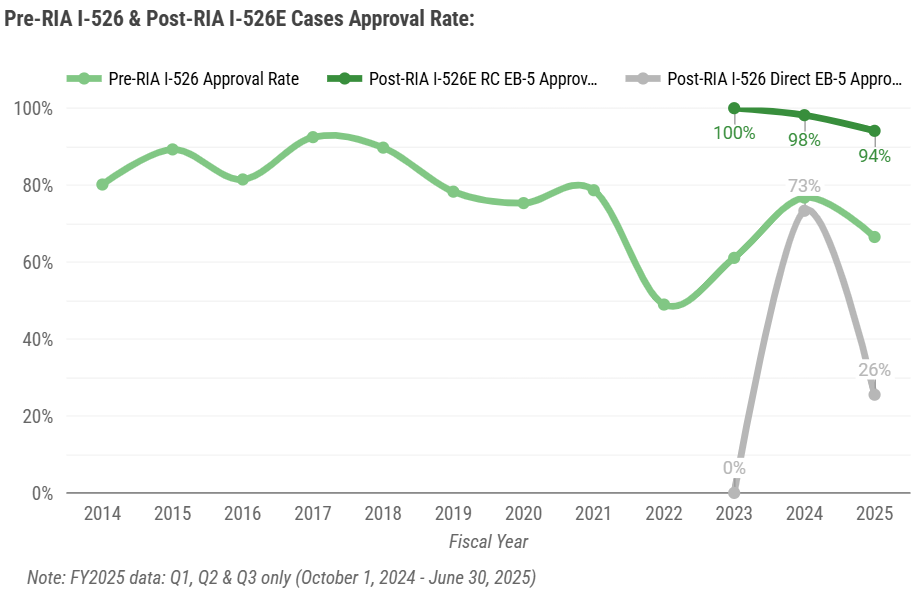

Approval rates and USCIS scrutiny

Historically, Direct EB-5 petitions have experienced lower approval rates than Regional Center filings, largely due to:

- Direct job creation failures

- Timing mismatches between hiring and adjudication

- Insufficient business planning

- Documentation deficiencies

Source: IIUSA

USCIS adjudicators apply the standards set out in USCIS Policy Manual, Volume 6, Part G, with particular scrutiny on payroll, tax filings, and business operations.

Management Involvement and Passive Investment

Overview: The Myth of EB-5 Passive Investment

The Myth: A common misperception is that Direct EB-5 requires direct management involvement whereas Regional Center EB-5 involves a “passive” investment.

The Law: The petitioner must be engaged in the management of the new commercial enterprise, either through the exercise of day-to-day managerial control or through policy formulation. 8 CFR §204.6(j)(5)

This rule applies to all EB-5 investors, whether standalone or regional center. There is no different regulatory standard for regional center investors.

The Truth: As a practical matter Regional Centers rely on the rights granted to investors under State Partnership and LLC statutes. Consulates frequently ask investors about their project precisely to ensure that their role is not purely “passive”.

A Business Owner as an EB-5 Investor

While many business owners do use Direct EB-5, it is false to assume that all Direct (Stand-Alone) investors are business owners. Many Direct (Stand-Alone) EB-5 investors simply provide financing to an existing project or business.

An investor pursuing a Direct EB-5 will have to undertake due diligence and work typically performed by Regional Centers.

Risk Assessment and Mitigation

Direct Investment Risks

Direct (or Stand-Alone) EB-5 can be made in any qualifying business, large or small. However, Direct EB-5 investments are frequently made by business owners who control a business. Those businesses often represent exposure to the operating risk of the business.

10 permanent “W-2” jobs must be directly created and sustained in a Direct EB-5 case. Maintaining and managing those jobs is more complex than in a Regional Center case. For that reason Direct EB-5 often suits an investor opening a qualifying U.S. business regardless and independent of their immigration needs.

Regional Center (RC) Risks

Investing in a Regional Center EB-5 can present a number of risks. These include:

- Competency. Does the RC have staff with sufficient expertise and training to be conducting proper project underwriting and asset management?

- Conflicts. Some RCs also fill the role of the developer. This creates a risk of a conflict of interest. An RC needs to critically review a developer's project and be able to take steps (including litigation) against the developer to protect the position of investors.

- Who is the RC's Client? Borrowers seek out Regional Centers to assist them with raising capital. Where an RC consistently assists a borrower to raise EB-5 capital over time the borrower effectively becomes the RC's client.

Regional center investments may offer more predictable outcomes through professional management and established track records, but investors must carefully evaluate the regional center's history, management team, and project fundamentals.

Documentation and Administrative Requirements

Direct Investment Documentation

EB5 direct investment typically involves more straightforward documentation requirements, as investors maintain direct control over business records and financial reporting. Documentation focuses on business formation, employment records, and investment fund tracking.

The direct relationship between investor and enterprise simplifies many compliance requirements, though investors must ensure proper documentation of all program requirements without professional EB-5 guidance.

Regional Center Documentation

EB5 regional center investments involve more complex documentation due to pooled investment structures and multiple stakeholders. Investors must navigate subscription agreements, private placement memoranda, and detailed project documentation.

Regional centers typically provide comprehensive compliance support and documentation services, though the complexity of pooled investments may require additional legal and financial analysis.

Administrative Fees and Costs

Direct Investment Costs

EB5 direct investment generally involves lower administrative fees, as investors avoid regional center management fees and administrative charges. However, direct investors must budget for legal, accounting, and business consulting services to ensure proper compliance and business management.

The cost structure for direct investments varies significantly based on business type, location, and complexity, but typically excludes the substantial administrative fees associated with regional center participation.

Regional Center Costs

EB5 regional center investments include additional administrative fees ranging from $50,000 to $80,000 typically, covering project management, compliance monitoring, and investor services. These fees represent the cost of professional management and reduced investor responsibilities.

While regional center fees increase total investment costs, they provide access to professional expertise and potentially more predictable outcomes through experienced project management.

Who Regional Center EB-5 is best suited for

Regional Center EB-5 is typically appropriate for investors who:

- Prefer a hands-off investment

- Do not want to manage employees or operations

- Are focused on immigration certainty

- Want to rely on economic job modeling permitted under USCIS policy

This pathway accounts for most EB-5 filings globally.

Who Direct (Stand-Alone) EB-5 is best suited for

Direct EB-5 is typically appropriate for investors who:

- Are entrepreneurs or business owners

- Want control over capital deployment

- Are expanding or launching an operating business

- Are transitioning from E-2 or L-1 to permanent residence

- Are prepared to meet the stricter evidentiary standards of 8 CFR §204.6(j)

Immigration risk vs business risk

Neither EB-5 pathway eliminates risk. The difference lies in where the risk sits.

- Regional Center EB-5 places greater reliance on the project sponsor, economic modeling, and capital stack structure.

- Direct EB-5 places greater reliance on the operating business and its ability to actually create and sustain qualifying jobs.

All EB-5 investments must remain “at risk” as required by 8 CFR §204.6(j)(2) and USCIS policy.

Why investors choose Direct EB-5 through lack of understanding

In our experience, many EB-5 investors make the same mistake at the decision stage. They assume that greater personal control over a business automatically means lower risk.

That misconception applies in two separate ways:

Misconception 1: Immigration risk

Investors often assume that if the business is real and they intend to hire, the immigration outcome should follow.

In reality, Direct (Stand-Alone) EB-5 requires the enterprise to create and sustain ten qualifying direct, full-time W-2 jobs supported by real payroll and business records. If hiring is delayed, jobs cannot be sustained, or the business underperforms, the immigration case can fail even where the investor's intentions were genuine.

Misconception 2: Financial risk

Investors also assume that investing in a business they can see, influence, or that involves family feels safer than investing through a third-party project structure.

But control does not necessarily reduce financial exposure. New operating businesses fail frequently, and Direct EB-5 ties both immigration and capital outcomes more closely to the performance of the enterprise itself.

How Regional Center EB-5 allocates risk differently

With Regional Center EB-5, job creation is often supported through indirect and induced job methodology accepted under USCIS policy. In many cases, this reduces job-counting risk because the investor is not required to prove ten sustained W-2 employees on the enterprise's payroll in the same way. This does not remove risk, but it changes where the risk sits.

Example Case 1: Financial risk misconception

Control can feel safer but be riskier

Background: One of our clients was deciding between two options:

Option 1

A Regional Center EB-5 investment.

Option 2

A Direct EB-5 investment in a factory operated by a close family member.

Because the investment represented a substantial portion of the family's savings, the client wanted the option that felt safer. The client chose the family operated business because it felt more controllable and transparent than a third-party project.

The factory later failed. The business did not succeed at the required scale, the investment was lost, and the client did not obtain permanent residence through EB-5.

In the Regional Center project the client had also evaluated, investors in that specific offering obtained approvals and capital was repaid when the project completed. This fact is included to illustrate how different EB-5 structures allocate risk. Past outcomes are project-specific and do not predict future results.

Summary: Which EB-5 option is right for you?

There is no universally better EB-5 path.

The correct choice depends on:

- Your tolerance for operational involvement

- Your business experience

- Your immigration timeline

- Your source of funds profile

- Whether you already operate a qualifying enterprise

Most EB-5 failures stem not from the law, but from choosing the wrong structure at the outset.

Next steps

- Read the full program overview in our EB-5 Visa Guide

- Explore operating your own business through Direct EB-5

- Speak with an experienced EB-5 lawyer before committing capital

Related EB-5 Resources

EB-5 Form Guides