EB-5 Direct (Stand-Alone EB-5) Investment Guide

EB5 RequirementsEB5 ProcessEB5 Visa Processing TimeEB5 Visa CostEB5 Visa GuideGuide to Selecting an EB5 Lawyer

Key Takeaways

- Invest directly in your own US business, not a regional center

- Create 10 direct full time W2 jobs

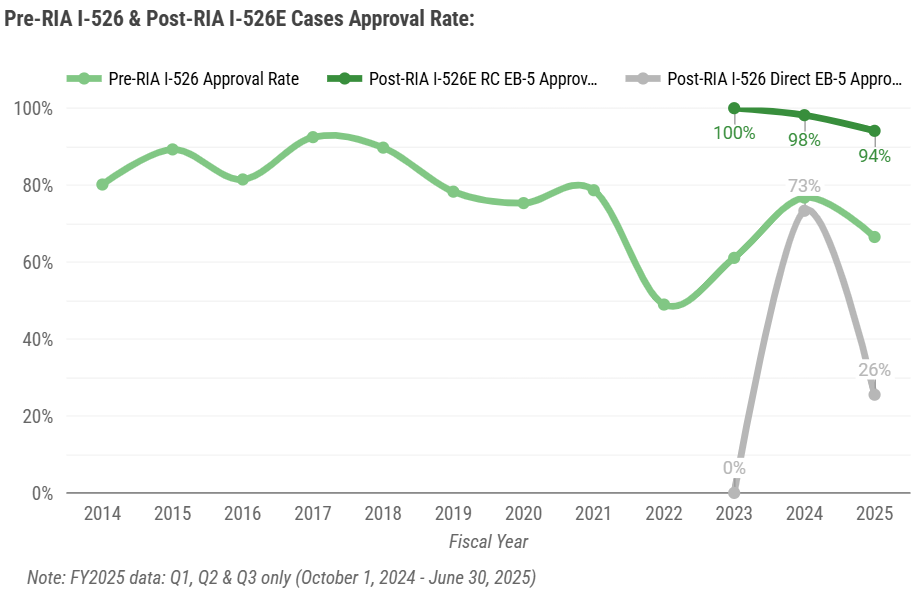

- Approval rates are historically lower than Regional Center EB-5 due to direct job creation requirements

- File Form I-526, not I-526E

- Capital loss risk can be higher than with well structured Regional Center EB-5 projects

- More operational risk and heavier evidence burden than regional center EB-5

Table of Contents

- ► What is Direct (Stand-Alone) EB-5?

- ► Who Uses Direct (Stand-Alone) EB-5?

- ► The Direct (Stand-Alone) EB-5 Job Creation Requirement

- ► Legal Framework for Direct (Stand-Alone) EB-5

- ► Who Direct (Stand-Alone) EB-5 is Best Suited For

- ► EB-5 Direct Investment Requirements

- ► Form I-526 vs Form I-526E

- ► What Type of Projects Qualify for EB-5 Direct?

- ► Disadvantages of Direct (Stand-Alone) EB-5

- ► EB-5 Direct Process Overview

- ► Raising Capital Using EB-5 Direct

- ► Frequently Asked Questions

What is Direct (Stand-Alone) EB-5?

Direct, or Stand-Alone, EB-5 is the non regional center version of the EB-5 Immigrant Investor Program. Established under INA §203(b)(5), EB-5 allocates immigrant visas to investors who:

- Invest the required minimum capital in a New Commercial Enterprise (NCE)

- Can show their investment created jobs for at least 10 U.S. workers

Instead of investing through a USCIS designated regional center, the investor places capital directly into a qualifying US business and must demonstrate that the enterprise itself creates the required jobs, as governed by 8 CFR §204.6.

Who Direct (Stand-Alone) EB-5 is Best Suited For?

Direct (Stand-Alone) EB-5 is most appropriate for investors who: - Want to start and operate their own US business - Have previous entrepreneurial or management experience - Prefer direct control over business operations and hiring - Are comfortable with the higher operational and evidentiary burden - Have a viable business plan that can realistically create 10+ W2 jobs - The managerial role requirement is outlined in 8 CFR §204.6(j).Jobs that Count for Direct (Stand-Alone) EB-5

These 10 jobs must be:

- Direct, that is direct employees of the business

- Permanent

- Full time

- On the payroll of the enterprise receiving the EB-5 investment, i.e. “W-2” employees of the enterprise

- The jobs must be necessary and needed for the operation of the business

⚠️ Warning – D&A Insight (Don’t Payroll Jobs)

Our firm has seen a number of cases where a client has kept employees “on payroll” who are no longer needed by the business for EB-5 job creation purposes.

USCIS will deny cases where employees are kept on payroll purely for EB-5 job creation purposes.

EB-5 Direct is most often used by:

- Founders

- Owner operators

- Investors in family businesses

- Investors in businesses hoping for higher returns than are typically seen in a structured Regional Center EB-5

- Investors who want direct control over their business and a transparent link between capital deployment and job creation.

EB-5 investors tend to trust family. Often failed Eb-5 visa cases come from investments in family businesses. This is because even while family members may be trustworthy it does not make their businesses inherently strong. Because of the job creation rules, failed Direct EB-5 cases are more likely to result in visa denial.

The Direct (Stand-Alone) EB-5 Job Creation Requirement

Direct EB-5 job creation evidence typically includes:

- Payroll and W-2 records

- Proof each job is full-time (35+ hrs/week)

- I-9 compliance documentation

- Business tax filings and wage reports

- Hiring timeline consistent with the Matter of Ho business plan.

The current EB-5 Regional Center program is authorized through Sept. 30, 2027. However, there is an earlier "sunset" date for the "grandfathering provisions" on Sept. 30, 2026. "Grandfathering provisions" refers to the RIA provisions that preserve eligibility and certain benefits/protections for qualifying filings. With grandfathering provisions gone, most lawyers believe that as a practical matter the Regional Center program will end on Sept. 30, 2026.

Bottom Line: Direct (Stand-Alone) EB-5 does not sunset or expire, only the Regional Center program expires in Sept. 2027.

The defining feature of EB-5 Direct (Stand-Alone EB-5) is job creation methodology.

USCIS requires that the investment result in the creation of at least ten direct, permanent, full time jobs for qualifying US workers. USCIS Policy Manual, Vol 6, Part G, Chapter 2.

Creating 10 direct jobs is the single largest reason that over 90% of EB-5 cases are filed through Regional Centers.

These jobs must be:

- Direct

- Permanent

- Full time

- On the payroll of the enterprise receiving the EB-5 investment

Jobs that Do Not Count for Direct (Stand-Alone) EB-5

- 1099 contractors

- Employees of third party vendors or staffing firms not on the enterprise payroll

- Indirect or induced jobs

- The investor's own position

Matter of Ho and the EB-5 Business Plan

Overview: Direct EB-5 Business Plans

A USCIS-compliant EB-5 business plan is the single most important part of any Direct (Stand-Alone) EB-5 Petition. U.S. Citizenship and Immigration Services (USCIS) evaluates your business plan under the legal standards established by Matter of Ho, a precedent which sets out what USCIS expects in terms of detail, credibility, and feasibility.

What is a Matter of Ho?

The Matter of Ho is an immigration case where the Administrative Appeals Office laid out criteria needed for a business plan to be compliant for EB-5 purposes. Under the criteria in Matter of Ho, any EB-5 Direct business plan must show:- A credible and realistic description of the business model

- A supported market and industry analysis

- A detailed job creation timeline showing how at least 10 full-time W-2 jobs will be created for U.S. workers

- Logical financial projections that align with your investment and hiring assumptions

- Evidence that your capital is legitimately at risk and will be deployed in support of the enterprise’s operations and growth

D&A Insight: Business Plan Requirements

A Matter of Ho business plan must be substantially more detailed than a standard commercial business plan or a plan used in loan applications.

Other regulations and court decisions have significantly added complexity to the factors laid out in the Matter of Ho precedent.

Recommendation: EB-5 Direct applicants should have their business plan reviewed by an experienced EB-5 lawyer to avoid summary denials.

Legal Framework for Direct (Stand-Alone) EB-5

EB-5 Direct (Stand-Alone EB-5) is governed by:

- INA §203(b)(5), which establishes the EB-5 classification

- 8 CFR §204.6, which sets out petition requirements, capital rules, and job creation standards

- USCIS Policy Manual Volume 6, Part G, which provides adjudicatory guidance

Although the Foreign Affairs Manual (FAM) does not create EB-5 eligibility rules, it governs how EB-5 visas are processed at US consulates once a petition is approved.

Who Direct (Stand-Alone) EB-5 is Best Suited For

Direct (Stand-Alone) EB-5 is most appropriate for investors who:

- Want to start and operate their own US business

- Have previous entrepreneurial or management experience

- Prefer direct control over business operations and hiring

- Are comfortable with the higher operational and evidentiary burden

- Have a viable business plan that can realistically create 10+ W2 jobs

The managerial role requirement is outlined in 8 CFR §204.6(j).

Direct EB-5 vs Regional Center EB-5: Comparison

| Feature | Direct (Stand-Alone) EB-5 | Regional Center EB-5 |

|---|---|---|

| Legal Basis | INA §203(b)(5); 8 CFR §204.6 | INA §203(b)(5); EB-5 Reform and Integrity Act of 2022 |

| USCIS Petition Form | Form I-526 | Form I-526E |

| Job Creation Requirement | 10 direct, full-time W2 employees | 10 jobs (direct, indirect, or induced) |

| Management Involvement | Active role in day-to-day operations or policy-making | Passive investment permitted |

| Job Calculation Methodology | Actual payroll records required | Economic modeling (RIMS II, IMPLAN) accepted |

| Investment Control & Risk | Full control; higher operational risk | Limited control; risk depends on project structure |

| Who It's Best Suited For | Entrepreneurs, owner-operators, family businesses | Passive investors seeking lower operational burden |

EB-5 Direct (Stand-Alone EB-5) Investment Requirements

To qualify for permanent residence through EB-5 Direct (Stand-Alone EB-5), the investor must:

- Invest the required amount of capital into a qualifying US commercial enterprise

- Demonstrate the capital was lawfully sourced

- Show that the investment created or will create at least ten qualifying jobs

USCIS defines full time employment as a minimum of 35 working hours per week, consistent with 8 CFR §204.6(e).

All EB-5 investments must remain at risk for the purpose of generating a return, as required by regulation and USCIS policy.

Minimum Investment Amount

The required investment amount depends on whether the enterprise is located in a targeted employment area:

- $800,000 USD if located in a rural area or high unemployment area

- $1,050,000 USD if not located in a targeted employment area

USCIS Policy Manual, Vol 6, Part G, Chapter 2

Targeted employment area determinations are fact specific and must be verified before capital is committed.

Form I-526 vs Form I-526E for EB-5 Direct (Stand-Alone EB-5)

Direct EB-5 (Stand-Alone EB-5) cases are filed using Form I-526, not Form I-526E.

Form I-526

Form I-526 is used by investors whose EB-5 investment is not associated with a regional center and relies on direct job creation. This is the standard petition form for EB-5 Direct (Stand-Alone EB-5) cases.

Form I-526E

Form I-526E is reserved for regional center sponsored investments under the EB-5 Reform and Integrity Act framework and is not generally applicable to standalone EB-5 structures.

For a detailed comparison of filing strategy and evidence requirements, see our I-526 forms guide.

📖 Read Our Guide to

What Type of Projects Qualify for EB-5 Direct?

Any project that requires the requisite amount of investment capital which creates at least ten jobs potentially qualifies for EB-5 Direct. Examples of projects our clients have undertaken include:

- Opening gas stations

- Adding convenience stores to gas stations

- Opening and expanding trucking and transportation businesses

- Opening a chain of hair salons

- Building hotels

- Building factories

EB-5 Example: Opening a Gas Station

Our Client: Indian Investor Opening a Gas Station in California

Challenge: One Gas Station did not create 10 direct jobs

Solution: By adding food franchises to the Gas Station our client was able to generate more than the required jobs.

EB-5 Example: Chain of Hair Salons

Our Client: Indian Investor Opening a Chain of Hair Salons

Challenge: Our client wanted to open one hair salon which required less than the required EB-5 investment. The client planned to slowly grow his investment slowly over the first two years by opening more salons.

Solution: We assisted the client to prepare a detailed business plan evidencing his compliance with the EB-5 regulations. By placing the full investment in an escrow account from which the funds could not be released except in accordance with his business plan the investor was able to secure an I-526 approval. By the time of I-829 the full required investment had been made and the case was approved.

Disadvantages of Direct (Stand-Alone) EB-5

While EB-5 Direct (Stand-Alone EB-5) offers control and transparency, it also carries meaningful disadvantages that investors should understand.

Higher Evidentiary Burden

Direct (Stand-Alone) EB-5 cases require documented proof of actual job creation, not economic projections. USCIS officers closely scrutinize payroll records, tax filings, and business operations. USCIS Policy Manual, Vol 6, Part G

Operational Risk

Because the investor controls the enterprise, business failure or delayed hiring directly impacts immigration eligibility. There is no buffer from indirect job modeling as exists in regional center cases.

Approval Rates

Historically, Direct (Stand-Alone) EB-5 petitions have experienced lower approval rates than regional center cases, largely due to:

- Inadequate business plans

- Failure to sustain ten qualifying jobs

- Timing mismatches between hiring and adjudication

- Poor documentation of lawful source of funds

USCIS does not publish separate approval statistics by project type in the regulations, but adjudicatory guidance consistently reflects stricter scrutiny for direct job creation cases under 8 CFR §204.6 and the USCIS Policy Manual.

For this reason, EB-5 Direct (Stand-Alone EB-5) cases require unusually careful planning and coordination between immigration counsel and business advisors.

EB-5 Direct (Stand-Alone EB-5) Process Overview

A compliant EB-5 Direct (Stand-Alone EB-5) case typically follows this sequence:

- Select or structure the qualifying enterprise

- Design a hiring plan that supports ten qualifying jobs

- Confirm targeted employment area status if applicable

- Align capital deployment with job creation timelines

- Prepare lawful source of funds documentation

- File Form I-526

- Obtain conditional permanent residence

- File to remove conditions once job creation is proven

INA §216A and 8 CFR §216.6 govern the removal of conditions stage.

Raising Capital Using EB-5 Direct

Although the recent passage of the RIA made it harder to raise capital from foreign investors using Direct (Stand-Alone) EB-5 it is still possible to do so. This is especially the case where smaller numbers of investors are involved.

It also remains possible to combine EB-5 Direct and EB-5 Regional Center approaches in the same project.

At Davies & Associates we place a team of lawyers around every client seeking to raise EB-5 capital. This team involves a senior and experienced EB-5 lawyer together with corporate lawyers, typically a taxation lawyer, real estate lawyers and corporate lawyers. Our firm also has a specialist team which works to prepare EB-5 Direct Business Plans.

Our deep knowledge of international markets and EB-5 investors uniquely positions us to assist business owners seeking to raise capital through EB-5.

Frequently Asked Questions

What is Direct (Stand-Alone) EB-5?

Direct (Stand-Alone) EB-5 is the version of the EB-5 Immigrant Investor Program where the investor places capital directly into a qualifying US business and creates jobs through that enterprise, rather than investing through a USCIS-designated regional center.

How is Direct (Stand-Alone) EB-5 different from Regional Center EB-5?

With Direct (Stand-Alone) EB-5, all required jobs must be direct, permanent, full time W2 positions on the enterprise payroll. Regional Center EB-5 projects may count indirect and induced jobs using economic modeling.

How many jobs are required for Direct (Stand-Alone) EB-5?

The investment must create at least 10 qualifying full time jobs for US workers. Each job must generally involve at least 35 hours per week and be permanent in nature.

What type of jobs count?

Only direct employees of the enterprise count. Independent contractors, consultants, and third-party workers typically do not qualify for Direct (Stand-Alone) EB-5 job creation purposes.

How much investment is required?

The minimum investment is generally:

- $800,000 USD if the business is located in a targeted employment area

- $1,050,000 USD if the business is not located in a targeted employment area

The applicable amount depends on timing and location and should be confirmed before investing.

Which petition form is used for Direct (Stand-Alone) EB-5?

Direct (Stand-Alone) EB-5 cases are filed using Form I-526. Form I-526E is used for regional center investments and generally does not apply to standalone Direct (Stand-Alone) EB-5 cases.

When must the jobs be created?

The required jobs must be created within the applicable period and shown to exist at the time the investor files to remove conditions on permanent residence.

Is Direct (Stand-Alone) EB-5 riskier than Regional Center EB-5?

Yes, in many cases. Because job creation must be proven through actual business operations and payroll, Direct (Stand-Alone) EB-5 involves higher operational and evidentiary risk than well structured regional center projects.

Are approval rates lower for Direct (Stand-Alone) EB-5?

Historically, Direct (Stand-Alone) EB-5 cases have experienced lower approval rates than regional center cases, largely due to stricter scrutiny of job creation, business viability, and documentation.

Can an investor lose their capital in Direct (Stand-Alone) EB-5?

Yes. EB-5 investments must be at risk, and business failure can result in partial or total loss of capital. This risk can be higher in Direct (Stand-Alone) EB-5 because the investor bears direct operational responsibility.

Can multiple investors use the same Direct (Stand-Alone) EB-5 business?

Multi-investor Direct (Stand-Alone) EB-5 structures are possible but significantly more complex and must be carefully structured. In many cases, a regional center model is more appropriate for pooled investments.

Who is a good candidate for Direct (Stand-Alone) EB-5?

Direct (Stand-Alone) EB-5 is often suitable for entrepreneurs, owner-operators, and family business investors who want control over the business and are prepared to manage hiring, operations, and compliance closely.

Does the EB-5 Regional Center Program end in 2026?

No. The program is authorized through September 30, 2027.

Why do EB-5 lawyers treat September 30, 2026 as the practical deadline?

Because the RIA 'grandfathering provisions' relevant to certain protections and benefits have an earlier sunset date.

Awards

Contact Davies & Associates Offices in United States

Check all of our locations around the world.

Company location

New York Office World Trade Center

1 World Trade Center, Suite 8500, New York, NY 10007

Map and Driving Directions

New York Office E69th Street

200 E 69th Street, 2N, New York, NY 10022

Map and Driving Directions

California Office

555 Anton Blvd, Suite 150, Costa Mesa, CA 92626

Map and Driving Directions

Philadelphia Office

1500 John F Kennedy Blvd, Suite 450, PMB 41, Philadelphia, PA 19102

Map and Driving Directions

Los Angeles Office

601 South Figueroa Street, Suite 4050, Los Angeles, CA 90017

Map and Driving Directions

Chicago Office

155 N. Upper Wacker Dr., Suite 4250, Chicago, IL 60606

Map and Driving Directions

Miami Office

80 S.W. 8th St., Suite 2000, Miami, FL 33130

Map and Driving Directions

Atlanta Office

1075 Peachtree Street NE, Suite 3650, Atlanta, GA 30309

Map and Driving Directions

Telephone number

New York Office World Trade Center

+1 212 537 9196

Fax: +1 949 396 1371

New York Office E69th Street

+1 212 537 9196

Fax: +1 949 396 1371

California Office

+1 949 620 1811

Fax: +1 949 396 1371

Philadelphia Office

+1 215 525 1881

Fax: +1 949 396 1371

Chicago Office

+1 312 261 8560

Fax: +1 949 396 1371

Miami Office

+1 305 423 7163

Fax: +1 949 396 1371

Contact us by email

Looking to acquire an EB5 direct?

We are known for our creative solutions that obtain "impossible" visas, we solve the most complex immigration problems for businesses, investors, individuals, and families.

EB5 direct Immigration lawyer near meSeveral lawyers told me I would not be able to get a TN visa. Two weeks after contacting Davies & Associates I was working in New York, visa in hand.

Individual seeking 'Impossible' TN VisaD&A was very detail-oriented and was very thorough in what they did” L1 Visa Client. There was a lot of work on my case and worked on it 24/7 and was very patient answering all my questions.

E2 Visa ClientMy case felt complex but D&A managed the whole process carefully and helped me move seamlessly from one stage to the next.

E2 + CBI ClientD&A was my guiding light through the entire EB5 Process.

EB5 Visa ClientI would definitely be a big advocate for the rest of my life for anyone wanting to explore the Grenada Citizenship by Investment Programme leading to the E2 Visa. The most important thing is a good team behind you.. with Davies & Associates you’re in safe hands… you need someone who can give you all the support at the ground level and, again, you are well take care of by D&A. The people are really warm, very helpful and quite openminded when it comes to business… Not to mention as a passport it’s great from a travel perspective…It’s just 4/5 hours from New York.

Grenada CBI + E2 Visa ClientThe entire process of getting an EB5 visa is handled in a professional way by Mark Davies and his team. EB5 is a wonderful option for anyone considering moving to the United States if you have the means. I was hoping to use the H1B route for my children, but it became unreliable and so I looked to the EB5 Visa instead. It is great for anyone who has the resources. Mark gives you the first meetings himself which gives you great comfort. Both Mark and Sanjay are abundantly available and I even had the pleasure of hosting them at my house.

Parent of 2 EB5 Visa HoldersI'm in a process of extending my L1 visa. I submitted a few questions regarding my case and he contacted me back almost immediately both by e-mail and telephone. Unlike other attorneys I met before, he gave me the impression of knowing from the top of his head what kind of visa I have, and what actions had to be taken to extend it. He is very thorough and clear regarding the process and what to expect in terms of timelines and issues that may arise. He is constantly in contact, so you definitely know he's working on your case.

L1B Visa HolderMark Davies is a joy to work with. His extensive knowledge, speedy response and attentive service took away all my fears of dealing with immigration and visa applications. He is very generous with his time in explaining every step along the way and I have already and will in the future recommend him to anybody who is looking for an immigration lawyer.

E2 Visa for Small Professional Business With International OfficesDavies & Associates assisted us with an immigration emergency involving my brother's fiancée who was outside the United States. They assisted us in a highly professional manner, working with the relevant US embassy, US immigration and the governments of two other countries. As a result of their efforts the individual involved is now working in the United States. While their knowledge of the law is exemplary what really distinguishes this firm and attorney Davies from any other firm we have worked with is their dedication to customer service and their unrivaled level of professionalism.

Complex Fiancée Visa Need Involving Multiple International JurisdictionsSeveral lawyers told me I would not be able to get a TN visa. Two weeks after contacting Davies & Associates I was working in New York, visa in hand. I have recommended this firm to several friends and colleagues, they do an excellent job every time.

Individual Seeking 'Impossible' TN VisaI was qualified as a physician in a foreign country. Being on a J1 visa I was facing having to leave the United States and return to my home country. Davies & Associates secured one of only 30 J1 visa waivers available in my State, allowing me to work for a US hospital and remain in the United States.

Doctor Seeking J1 Visa WaiverI am very satisfied with the services Mark Davies has provided me. He has a very extensive knowledge in immigration laws and has a thorough approach to any case.

U Visa Applicant, A Victim of CrimeLooking to relocate or having trouble with a visa application?

We are known for our creative solutions that obtain "impossible" visas, we solve the most complex immigration problems for business, investors, individuals and families.

Request Free Consultation